The Tax-Savvy Real Estate Investor

Tax Tips & Wealth Building Insights

FEBRUARY 2025

Overview

01

02

OBJECTIVE

03

PROBLEM

Staying current with ever-evolving tax codes, accounting standards, and market shifts is challenging and time-consuming, especially for busy real estate investors and entrepreneurs. Mistimed acquisitions, missed deductions, and lack of awareness about impending legislative changes can erode profits and stall growth. Our playbook solves this problem by providing timely, curated, and expert-driven guidance—all in one place—so you can confidently take proactive action rather than react late to tax and regulatory changes.

04

CONTACT US

At Aiola CPA, we measure our success by your results. By combining technical expertise, industry specialization, personal investment experience, and a client-centered approach, we aim to help you reduce tax liabilities, streamline operations, and ultimately build long-term wealth through real estate.

Ready to Take the Next Step?

Contact Us Today

CPA Insights

Welcome to this month’s CPA Insights, where we unpack pivotal tax and economic updates affecting real estate professionals across the US. With President Donald Trump’s second term kicking off in 2025, his administration is already signaling bold moves on tax policy and economic strategy that could reshape your financial planning. In this February edition, we spotlight two key areas: Trump’s major income tax proposals—including a fresh development on bonus depreciation—and economic factors like tariffs and Social Security that could influence your real estate operations.

A. Trump Tax Proposals: Big Income Tax Changes on the Horizon

What’s Happening Now

As of February 2025, the Trump administration is advancing an ambitious tax agenda, with several blockbuster income tax proposals under consideration. Here’s the latest:

- Bonus Depreciation Revival: On February 20, 2025, Trump announced his administration is actively considering reinstating 100% bonus depreciation, reversing the ongoing phase-down from the TCJA. Currently at 60% in 2024, it’s slated to drop to 40% in 2025, 20% in 2026, and 0% in 2027. This shift could retroactively apply to 2025 or earlier, pending Congressional action.

- Extension of the 2017 Tax Cuts and Jobs Act (TCJA) Provisions: The TCJA’s individual tax cuts—lower rates, doubled standard deduction, and the 20% Qualified Business Income (QBI) deduction—are set to expire December 31, 2025. Trump aims to make these permanent, including lifting the $10,000 State and Local Tax (SALT) deduction cap, a critical issue for property owners in high-tax states.

- Elimination of Federal Income Tax on Social Security Benefits: Trump continues to push his campaign promise to exempt Social Security benefits from federal income tax. Currently, up to 85% of benefits are taxable for individuals with combined income over $34,000 (or $44,000 for joint filers)—thresholds unchanged since the 1990s. This could take effect as early as 2026 if passed.

- Abolishment of Federal Income Tax with Tariff Replacement: Trump has proposed a radical idea: eliminating federal income tax entirely, replacing it with revenue from steep tariffs (e.g., 10%-20% on all imports). Details are murky, but this could pivot tax burdens from income to consumption, potentially starting in 2026.

Your Next Steps

- Bonus Depreciation Timing: With Trump’s February 20 announcement, accelerating qualifying 2025 asset purchases could lock in 100% deductions if retroactively restored. Pair this with cost segregation studies to front-load write-offs on short-life assets (e.g., 5-year property like cabinets and countertops).

- SALT Strategy: If the cap lifts in 2026, deferring property tax payments (where allowed) could maximize deductions. For example, a $20,000 property tax bill in California becomes fully deductible, saving $7,400 at a 37% rate.

- Retirement Income Boost: The Social Security tax break could free up cash for reinvestment. Model this with your CPA to optimize rental income or capital gains offsets, especially if you’re in a higher bracket.

- Tariff-Driven Tax Shift: Model two scenarios: current income tax rules versus a tariff-only system. For instance, selling a $500,000 property might save $100,000 in capital gains tax, but higher material costs from tariffs could erode margins.

- Act Now on Legislation: These proposals hinge on Congress, with bonus depreciation talks heating up. Stay ahead—consult us to run 2025 projections under multiple outcomes (e.g., 40% vs. 100% bonus depreciation).

B. Economic Factors: Navigating Tariffs and Social Security

What’s Happening Now?

Trump’s economic policies extend beyond taxes, with ripple effects for real estate as of February 21, 2025:

- Tariffs: New orders impose 25% tariffs on Canada and Mexico imports (potentially effective March 1, 2025, after a 30-day pause) and 10% on Chinese goods, with broader 10%-20% tariffs proposed. Construction costs could climb as a result.

- Social Security Funding Risks: Exempting benefits from income tax, paired with potential payroll tax cuts (e.g., on tips), might cut $2.3 trillion from Social Security’s trust funds over 10 years, pushing insolvency from 2034 to 2031. This could affect retiree tenants or investors.

- Other Factors: Tariff-driven inflation may lift interest rates, cooling mortgage demand. Deportation policies could shrink construction labor, hiking project costs further.

Your Next Steps

- Tariff Cost Controls: Shift to US-sourced materials (e.g., domestic lumber over Canadian) to dodge tariff spikes. For a $100,000 rehab, a 25% tariff on $20,000 of imports adds $5,000—plan accordingly.

- Tenant Cash Flow: If Social Security solvency falters, test scenarios like a 30% benefit cut by 2031. For a retiree paying $1,500 monthly rent, that’s $450 less income—consider diversifying tenant bases or adding units.

- Rate Locks: With tariffs possibly pushing inflation, secure fixed-rate loans now. A 1% rate hike on a $1 million mortgage adds $10,000 annually—critical for multifamily or commercial deals.

- Labor Planning: Pre-book local contractors before deportation policies tighten labor supply. A 10% cost increase on a $50,000 project adds $5,000—lock in rates early.

These economic currents amplify tax policy impacts. Proactive planning with your CPA can turn challenges into opportunities.

Staying Informed and Proactive:

While no resource can predict future legislative outcomes with complete certainty, awareness of these current and impending changes empowers you to pivot your strategies accordingly.

At Aiola CPA, we emphasize proactive planning—running “what-if” scenarios, monitoring legislative updates, and collaborating closely with your legal and financial team—to ensure you remain agile, compliant, and poised to capitalize on opportunities in 2025 and beyond.

Evergreen Tax Strategies for Real Estate Investors

In the ever-shifting landscape of tax policy, some strategies stand the test of time, delivering consistent value to real estate investors. These “evergreen” approaches help you minimize tax burdens, preserve capital, and build wealth—year after year. Whether you’re managing rentals, flipping properties, or scaling a portfolio, these techniques offer reliable ways to optimize your tax position, especially when tailored to your real estate goals.

A. Opportunity Zone Investments

What It Is

Opportunity Zones (OZs), introduced under the 2017 Tax Cuts and Jobs Act, are economically distressed areas designated for tax-advantaged investments. By reinvesting capital gains into a Qualified Opportunity Fund (QOF) that funds projects in these zones, investors can defer, reduce, and potentially eliminate taxes on those gains. The rules remain in place as of February 2025, offering a powerful tool despite evolving political landscapes.

Why It Matters

OZ investments provide three key tax benefits:

- Deferral of capital gains tax until 2026 or the sale of the OZ investment

- A step-up in basis (10% if held 5 years, 15% if held 7 years) that reduces taxable gains

- Complete tax exclusion on new appreciation if held for 10 years.

For real estate investors, this can supercharge portfolio growth by redirecting tax dollars into property development or acquisitions, particularly in up-and-coming markets.

Example

Imagine selling a rental property in 2025 with a $400,000 gain. Instead of paying $80,000 in capital gains tax (at a 20% rate), you invest the proceeds into a QOF developing a multifamily project in an Opportunity Zone. You defer the tax until 2026, and if you hold for 10 years, any appreciation beyond the original gain is tax-free, saving you potentially hundreds of thousands over a traditional sale.

Action Steps

- Partner with Experts: Consult your real estate-specialized CPA to identify OZ-eligible gains and evaluate fund options. Timing is critical—gains must be reinvested within 180 days of realization.

- Research Zones: Target Opportunity Zones with strong growth potential, like revitalizing urban cores or emerging suburban hubs, to align tax savings with solid returns.

- Plan for the Long Haul: Commit to the 10-year hold to maximize tax-free appreciation, and integrate this with your broader portfolio strategy.

- Monitor Compliance: Ensure the QOF meets IRS rules (e.g., 90% of assets in OZ property), as noncompliance risks losing benefits.

B. Installment Sales for Property Dispositions

What It Is

An installment sale, governed by Section 453 of the Internal Revenue Code, allows you to spread the recognition of capital gains over multiple years when selling a property. Instead of receiving the full purchase price upfront, you accept payments (plus interest) over time, typically via seller financing. The gain is taxed proportionally as payments are received, rather than all at once.

Why It Matters

Spreading out gains can keep you in a lower tax bracket, reduce your immediate tax hit, and provide a steady income stream—ideal for real estate investors transitioning out of a property without triggering a massive tax event. It’s especially useful if you’re nearing retirement, managing cash flow, or avoiding the loss of other tax benefits tied to adjusted gross income (AGI).

Example

Suppose you sell a commercial property for $1 million, with a $600,000 gain. In a lump-sum sale, you’d owe $120,000 in capital gains tax (20% rate) in year one. Instead, you finance it with a $200,000 down payment and $800,000 paid over 8 years. Only $120,000 of the gain (20% of $600,000) is taxed in year one, with the rest spread annually, potentially dropping your tax rate to 15% ($18,000/year) if your income stabilizes—saving $24,000 total and smoothing cash flow.

Action Steps

- Assess Viability: Work with your CPA to model tax scenarios—compare lump-sum vs. installment tax liability based on your current and projected income.

- Structure the Deal: Set a fair interest rate (at least the Applicable Federal Rate) and secure the note with the property to mitigate buyer default risk.

- Track Payments: Maintain meticulous records of principal and interest, as each is taxed differently—your CPA can ensure proper reporting.

- Coordinate with Other Moves: Pair this with Opportunity Zone deferrals or retirement planning to stagger income and optimize AGI-related deductions.

Putting It All Together

These evergreen strategies—Opportunity Zone investments and installment sales—offer flexible, enduring ways to manage tax exposure while growing your real estate wealth. For instance, you might use an installment sale to spread gains from a property disposition, then funnel a portion into an Opportunity Zone fund, layering deferral upon deferral. With guidance from our team, you can customize these tools to your portfolio, ensuring tax efficiency that stands up to market shifts and policy changes. Ready to explore how these fit your 2025 goals? Let’s connect.

Case Study: 1031 Exchange for Commercial Redevelopment

Note: For client confidentiality, the names and certain details in this case study have been altered.

Client Background

The “Parker Group” is a closely held real estate development firm specializing in small-to-mid-sized commercial properties. Initially, the Parker family’s portfolio consisted of single-story retail spaces and light industrial buildings across the Midwest. Over time, they sought to transition into larger, higher-value properties to capitalize on the growing demand for distribution centers and commercial warehouses.

Initial Situation (Early 2024)

The Parker Group decided to sell a 50,000-square-foot light industrial property in Texas that had appreciated significantly since its purchase in 2015. The sale was poised to generate a substantial capital gain. Almost simultaneously, they identified a 100,000-square-foot warehouse in an up-and-coming logistics hub outside Kansas City. The new acquisition required significant renovations but promised higher long-term rents and value appreciation.

While the group wanted to reinvest proceeds from the Texas sale into the Kansas City warehouse, they faced the classic challenge of mitigating capital gains taxes through a 1031 exchange, all while addressing the property’s renovation needs in a tax-efficient manner.

Challenges Identified

- Capital Gains Exposure: The Texas property had appreciated by nearly 40% since its purchase, exposing the Parker Group to a large tax bill if they did not structure the sale-and-purchase properly.

- Tight 1031 Exchange Timelines: Under IRS rules, the Parker Group had 45 days post-sale to identify potential replacement properties and 180 days to complete the purchase, putting pressure on negotiations and due diligence.

- Renovation vs. Repair: The target warehouse needed upgrading to meet modern logistics standards, including installing a new loading dock system and climate control improvements. Determining which expenses could be currently expensed (as repairs) vs. capitalized was critical for short-term cash flow.

- Passive vs. Active Real Estate Income: Although Mr. Parker had recently increased his real estate involvement, his and Mrs. Parker’s income primarily came from a separate consulting business, risking the classification of rental income as passive and limiting immediate loss utilization.

Strategic Actions Taken

A. 1031 Exchange Structuring

- Sale & Identification: The Parker Group promptly listed the Texas property, timing the closing so it aligned with the start of their 1031 identification window.

- Identification Process: They identified the Kansas City warehouse as the primary replacement property within the 45-day window, and also listed a backup property for compliance.

- Exchange Accommodator: An experienced Qualified Intermediary (QI) was retained to hold the sale proceeds and facilitate the tax-deferred exchange.

Result: By following strict IRS 1031 rules, the Parker Group deferred the bulk of the capital gains tax that would have arisen from selling the Texas property.

B. Cost Segregation & Bonus Depreciation

- Engineering Analysis: Once the Kansas City warehouse was under contract, the Parker Group engaged a cost segregation firm to break down the property’s components (electrical systems, HVAC, parking lot, etc.).

- Asset Reclassification: The study identified approximately $1.5 million in short-life assets eligible for accelerated depreciation (5-, 7-, and 15-year classifications).

- Maximizing Bonus Depreciation: Even though bonus depreciation was phasing down to 60% in 2024, the timing allowed the Parker Group to claim a significant first-year deduction.

Impact: The cost segregation created an immediate tax shelter, reducing taxable income and improving liquidity for property improvements.

C. Real Estate Professional Status (REPS) & Property Management

- Increased Involvement: Mr. Parker officially dedicated over 750 hours per year to real estate activities, including overseeing property management, spearheading renovations, and scouting additional acquisitions.

- Documentation: Detailed hour logs, activity summaries, and management duties were maintained to substantiate REPS qualification.

- Benefit: As a Real Estate Professional, Mr. Parker could treat rental income and losses as nonpassive, offsetting a large portion of the couple’s W-2 consulting income.

Outcome: The Parker Group significantly reduced their overall tax liability through nonpassive treatment of rental losses.

D. Strategic Renovation Planning

- Separating Repairs from Capital Expenditures: Working with their CPA, the Parkers distinguished between deductible repairs (e.g., patching concrete, minor dock door fixes) and capital improvements (like a new HVAC system).

- Section 179 & 179D Deductions: High-efficiency lighting and improved insulation qualified for energy-efficiency incentives, enhancing both immediate deductions and the property’s long-term appeal to tenants.

- Renovation Timing: Some improvements were phased into the 2024 tax year to take advantage of available tax credits and bonus depreciation percentages.

Result: Thoughtful renovation planning boosted short-term deductions and minimized out-of-pocket cash flow strain.

Quantifying the Impact

- Tax Deferral & Savings: By completing the 1031 exchange, the Parkers deferred significant capital gains tax that would have been due from the Texas sale. Cost segregation and REPS status led to an additional $250,000 in first-year depreciation, lowering their 2024 tax liability by roughly $90,000.

- Increased Cash Flow: The tax savings helped fund the early stages of the warehouse remodel, reducing the need for outside financing. Upgraded warehouse features attracted a national logistics tenant, supporting higher rent and stabilizing the property’s income stream.

- Portfolio Expansion: With ongoing 1031 tax savings and improved cash flow, the Parker Group is already scouting a second warehouse in the same logistics corridor, potentially finalizing a purchase by mid-2025.

Conclusion & Lessons Learned

For the Parker Group, proactive tax planning through a well-executed 1031 exchange, cost segregation, and strategic renovation scheduling was a game-changer. They deferred immediate capital gains, increased depreciation deductions, and positioned themselves for future expansion. Key takeaways include:

- Leverage 1031 Exchanges to maintain the momentum of portfolio growth without facing prohibitive capital gains taxes.

- Don’t overlook cost segregation—especially for large commercial properties where multiple building components can qualify for shorter depreciation periods.

- Real Estate Professional Status is powerful, but it requires thorough record-keeping and genuine involvement.

- Plan renovations strategically, distinguishing between repairs (deductible) and capital improvements (capitalized), and exploring all energy-efficiency credits.

With the right blend of tax-savvy decisions and careful timing, real estate investors can optimize both near-term cash flow and long-term portfolio performance.

Avoid These Common Accounting Errors

Accurate accounting is the backbone of a thriving real estate business. Mistakes in your books can lead to missed tax deductions, cash flow missteps, or even IRS scrutiny—costing you time, money, and opportunities. While tax laws and economic conditions shift, avoiding these fundamental errors ensures your financial records remain a reliable tool for decision-making and growth. This month, we highlight two common pitfalls real estate investors must steer clear of to protect their bottom line

A. Failure to Log All Transactions

Why It Matters

Every dollar flowing in or out of your properties—whether it’s a tenant’s rent payment, a maintenance fee, or a utility bill—needs to be recorded. Missing even small transactions can distort your financial picture, understate income, or inflate expenses, leading to inaccurate tax filings or poor investment decisions. For real estate investors, untracked cash transactions (e.g., a handyman paid off-the-books) or overlooked bank fees can snowball into bigger problems, especially if audited.

Common Pitfalls

- Cash Deals: Paying vendors or collecting rent in cash without documentation is a frequent oversight, particularly for smaller landlords or flippers.

- Minor Expenses: Skipping entries for low-dollar items like a $50 repair part or bank service charge might seem trivial but adds up over multiple properties.

- Delayed Logging: Waiting weeks or months to record transactions risks forgetting them entirely, especially during busy rehab or leasing seasons.

Real Estate Impact

Unlogged transactions can jeopardize deductions—like repair costs or depreciation tied to improvements—if you can’t substantiate them. Worse, unreported rental income could trigger IRS penalties (e.g., 20% negligence penalty plus interest). For example, failing to log $5,000 in cash rent across a year might cost you $1,000 in taxes plus penalties, erasing margins on a tight deal.

Action Steps

- Use Digital Tools: Leverage accounting software and mileage trackers to log transactions on the go—for example, snap a receipt photo and categorize it instantly.

- Set a Schedule: Dedicate 15 minutes weekly to enter all receipts, invoices, and bank activity, ensuring nothing slips through.

- Document Cash: Issue receipts for cash payments (to tenants or vendors) and deposit funds promptly, tying them to a property-specific account.

- Cross-Check with Aiola CPA: Share your transaction logs with us throughout the year—we’ll spot gaps early and help you stay audit-ready.

B. Failure to Reconcile Accounts

Why It Matters

Reconciling your bank and credit card accounts against your books ensures they match, catching errors like double entries, missed payments, or fraudulent charges. For real estate investors juggling multiple properties or entities, skipping this step can hide cash flow leaks, misrepresent NOI (Net Operating Income), or delay spotting tenant payment issues. It’s not just about accuracy—it’s about trust in your financial data.

Common Pitfalls

- Infrequent Checks: Waiting until tax season to reconcile leaves months of errors undetected, complicating fixes.

- Overreliance on Software: Assuming auto-synced data from property management tools is flawless ignores bank-side discrepancies (e.g., unposted checks).

- Multi-Property Confusion: Without regular reconciliation, commingling or misallocated funds across properties can skew performance tracking.

Real Estate Impact

Unreconciled accounts might mean you miss a $2,000 duplicate contractor payment on a rehab, overstate expenses, and lose a deduction—or underreport income if a tenant’s $1,500 rent check bounces unnoticed. For lenders reviewing your DSCR (Debt Service Coverage Ratio), sloppy books could signal risk, jeopardizing financing terms on your next acquisition.

Action Steps

- Reconcile Monthly: Compare every bank statement to your accounting software within a week of receipt—flag variances immediately.

- Segregate Accounts: Maintain separate accounts per property or LLC (as noted last month) to simplify reconciliation and pinpoint discrepancies faster.

- Verify Deposits: Match rent deposits to lease terms; a shortfall could signal tenant issues or bank errors needing resolution.

- Lean on Aiola CPA: Let us review reconciliations quarterly—we’ll catch what you miss and optimize your process for tax season efficiency.

Tying It Together

Avoiding these errors—failing to log all transactions and skipping account reconciliations—builds a foundation of financial clarity critical for real estate success. A missed $100 repair or an unreconciled $1,000 deposit might seem minor, but across a portfolio, these slip-ups erode profits and expose you to risk. Pair diligent transaction tracking with monthly reconciliations, and you’ll not only dodge costly mistakes but also empower smarter investment moves. Need help tightening your books? Aiola CPA is here to ensure your accounting fuels growth, not frustration.

Market Outlook

Impact of the Recent Election on the Real Estate Market

TCJA Extensions & Foreclosure Protections

President Donald Trump has proposed extending certain Tax Cuts and Jobs Act (TCJA) provisions beyond 2025, potentially stabilizing real estate–focused tax benefits (e.g., bonus depreciation). However, any rollback of federal foreclosure protections could trigger more distressed listings—especially if serious delinquencies lose their current loss-mitigation “safety net.”

Regulatory Outlook & Market Volatility

With a Republican Congress broadly favoring reduced government involvement, agencies like HUD may shift toward limiting or phasing out existing homeowner relief programs. This introduces heightened uncertainty for homeowners on the brink of default or investors contemplating new acquisitions..

Residential Real Estate

Shifting to a Buyer’s Market?

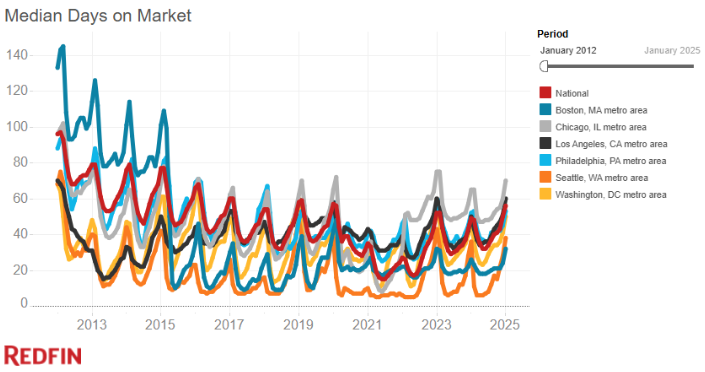

- Days on market hits five-year high. Redfin reports the average home now sits for 56 days, nearly double what it was at the pandemic peak. Some properties remain on the market 100+ days without significant price cuts. This extended timeline is giving buyers the upper hand in negotiations.

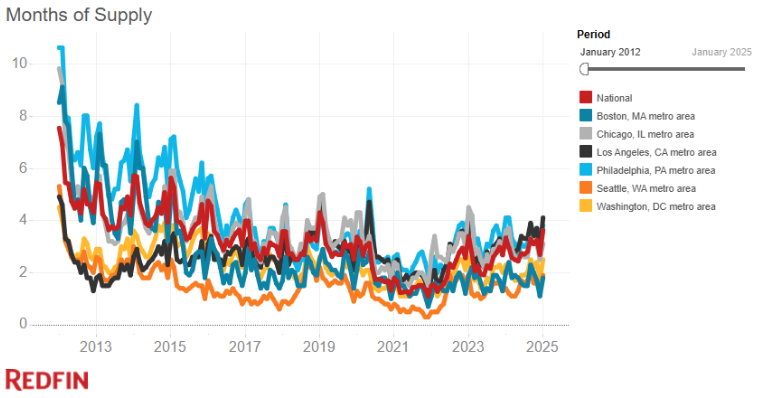

- Months of supply reaches 3.6. Inventory levels climbed to 3.6 months of supply, the highest since 2019. While this typically signals a pivot toward a more balanced or buyer-favorable market, many sellers are still reluctant to reduce asking prices—leading to rising standoffs.

Wall Street Sounds the Alarm on Overvaluation

- The stock of Invitation Homes (America’s largest single-family landlord, owning ~85,000 homes) has fallen 20% in the last four months and is trading at a 35% discount to its net asset value. Investors, in effect, are pricing these properties at about $310,000 each—compared to a current market value of $410,000—underscoring concerns that U.S. housing is overvalued by 10–35%.

- Institutional investors have heavy exposure in Southern markets (Florida, Texas, Georgia, the Carolinas), where inventory is swelling. Analysts attribute part of the discount to the risk of price declines in those “Sun Belt” areas.

Overvaluation Metrics & Home-Price-to-Rent Ratios

- Nationally, homes sell for about 15× annual rent—roughly 20–21% above the historical norm of ~12×. Markets like San Francisco can exceed 25×, while Denver and Salt Lake City hover around 20–22×. Such inflated ratios point to potential price corrections if rent growth fails to keep pace.

- Interestingly, some Florida markets display lower price-to-rent ratios (e.g., Punta Gorda at 8.5×). Yet, Florida’s incomes and rent fundamentals may also be in flux, indicating that what appears more “affordable” relative to rents could still face downward pressure if rents soften.

Inventory Spike & Seller Hesitation

- A combined total of ~800,000 homes are on the market in southern states when adding resale and new construction. This is the highest level in 7+ years, placing downward pressure on prices in growth markets like Orlando, Miami, Tampa, and parts of Texas.

- Despite slower sales, many homeowners and flippers are resisting price cuts, instead experimenting with short-term rentals, modest price reductions, or renovating in hopes of eventually achieving near-peak prices.

Rent Growth Slowdown

- U.S. single-family rent growth dipped below 2% in late 2024 and currently hovers around 1.5% year-over-year—the lowest since 2011. Markets like Austin, Orlando, and San Diego have already witnessed negative rent growth, intensifying pressure on investors reliant on steady rental income.

- Detroit bucked the trend with +6.1% annual rent growth; Washington, D.C. saw +5.5%. However, in the Sun Belt—where institutional ownership is high—rental demand is softening more significantly.

Commercial Real Estate

Office Market

- National vacancies hover around 16%, a slight improvement from 17% last quarter. Major hubs—New York and San Francisco—still exceed 20%, reflecting continued remote/hybrid work preferences.

- Rental Rates: Urban Prime – $70/sq. ft. in top-tier locations; Suburban – $25/sq. ft. (+3% vs. last quarter). Corporations are increasingly opting for flexible suburban spaces, which offer lower costs and shorter commutes.

Multifamily & Industrial

- With rising homeownership hurdles, rental demand remains healthy, keeping cap rates near 5.2%. Some investors, however, are re-evaluating after the recent slowdown in rent growth.

- E-commerce and logistics expansion maintain industrial vacancies at 4% nationally—a historic low—while lease rates have edged up to $8/sq. ft. This sector remains a bright spot for developers seeking stable yields.

Retail Sector

- Retail vacancy levels hover around 10%. Prime “high-street” corridors (NYC, LA, Chicago) command close to $50/sq. ft., while suburban mixed-use developments are drawing renewed interest as consumer foot traffic recovers.

Q&A: Top Questions from Our Clients

Real estate investors frequently turn to us with questions about navigating tax changes, economic shifts, and operational challenges. With 2025 ushering in new policies under the Trump administration, we’re addressing three timely inquiries we’ve heard this month. These answers provide a starting point—partnering with Aiola CPA ensures personalized strategies that maximize your real estate portfolio’s potential in this dynamic landscape.

Q: How could Trump’s proposed bonus depreciation changes affect my 2025 investments?

A: On February 20, 2025, President Trump announced plans to reinstate 100% bonus depreciation, reversing the current phase-down (60% in 2024, dropping to 40% in 2025). If enacted, this would allow you to deduct 100% of the cost of qualifying assets—like appliances, fixtures, or certain improvements—in the year they’re placed in service, rather than spreading deductions over years. For real estate investors, this could mean a massive upfront tax shield, especially when paired with cost segregation studies to identify short-life assets (e.g., 5- or 15-year property).

For example, a $200,000 rehab on a rental property might yield $120,000 in 5- or 15-year assets. At 100% bonus depreciation, you’d deduct that full amount in 2025, potentially saving $44,400 in taxes (at a 37% rate) versus $17,760 at 40%. However, this hinges on Congressional approval, and retroactivity isn’t guaranteed. Work with Aiola CPA to model scenarios—accelerating 2025 purchases could lock in bigger deductions if the policy passes, but we’ll also weigh timing against current 40% benefits if it stalls.

Q: Should I be worried about tariffs increasing my construction costs next year?

A: Trump’s new tariff orders—25% on Canada and Mexico imports (potentially effective March 1, 2025, after a 30-day pause) and 10% on Chinese goods, with broader 10%-20% tariffs proposed—could indeed raise costs for materials like lumber, steel, and fixtures. Real estate investors building or renovating properties may see budgets strained, especially if reliant on foreign supply chains. A $100,000 project with $30,000 in Canadian lumber could face an extra $7,500 hit, shrinking margins or forcing rent hikes.

Mitigate this by sourcing domestic materials now—U.S. lumber might cost more upfront but avoids tariff uncertainty. Lock in contractor rates early to hedge labor cost creep from supply shortages. Aiola CPA can run cost projections, factoring in tariffs and potential inflation-driven interest rate hikes, to help you adjust budgets or prioritize projects before March. Tariffs are a risk, but proactive planning keeps them manageable.

Q: How might Social Security changes impact my rental income strategy in 2025?

A: Trump’s proposal to eliminate federal income tax on Social Security benefits, potentially effective 2026, could boost retirees’ disposable income—good news if they’re your tenants. Currently, up to 85% of benefits are taxable for combined incomes over $34,000 (single) or $44,000 (joint). Removing this tax might add $5,000-$10,000 annually to a retiree’s cash flow, supporting rent stability or increases. However, funding concerns loom—exempting benefits could hasten Social Security insolvency (projected 2031 vs. 2034), risking future benefit cuts that might reverse this gain.

For 2025, target retiree-friendly rentals (e.g., single-story units) to capitalize on this short-term upside. Diversify tenant bases to hedge long-term solvency risks. Aiola CPA can stress-test your cash flow assuming a 30% benefit cut by 2031—e.g., a $1,500/month retiree tenant losing $450—and suggest adjustments like adding units or targeting younger renters. It’s a balancing act between opportunity and uncertainty.

Key Takeaway

These questions reflect the intersection of 2025’s tax proposals and economic shifts with real estate realities. From leveraging bonus depreciation to navigating tariffs and Social Security changes, success lies in anticipation and adaptation. Aiola CPA brings the clarity and foresight you need—let’s tailor these insights to your portfolio and turn policy changes into profitable moves.

Endnotes & Resources

At Aiola CPA, we aim to equip you with the knowledge and tools to navigate tax strategies, avoid accounting pitfalls, and seize real estate opportunities in 2025. This section ties together the insights from this month’s newsletter—covering Trump’s tax proposals, common errors, client Q&As, and the post-election market outlook—with legislative references and market data to support your next steps. Dive in, and let us help you turn information into action.

Legislative Guidance

Stay informed with these key legislative references and tax code sections to support this month’s topics:

- Bonus Depreciation Revival:

- IRS Code Section: 26 U.S. Code § 168(k) – Special Allowance for Certain Property

- Key Update: Currently at 60% in 2024, dropping to 40% in 2025 unless Trump’s February 20, 2025, proposal reinstates 100%. Qualifies assets with a recovery period of 20 years or less (e.g., fixtures, equipment). See “CPA Insights” and “Q&A.”

- Source: IRS Guidelines; X posts on Trump’s announcement (February 20, 2025).

- Social Security Tax Exemption:

- IRS Code Section: 26 U.S. Code § 86 – Social Security and Tier 1 Railroad Retirement Benefits

- Key Update: Trump’s plan to eliminate income tax on benefits (potentially 2026) could shift retiree cash flow, though funding risks loom. Referenced in “CPA Insights” and “Q&A.”

- Source: Social Security Administration Projections (insolvency 2031 if unchanged).

- Tariff Impacts:

- Legislative Context: Trade Expansion Act of 1962; Trump’s Executive Orders (effective March 1, 2025, pending pause)

- Key Detail: 25% tariffs on Canada/Mexico imports, 10% on China, with broader 10%-20% proposed. Impacts construction costs—see “CPA Insights,” “Q&A,” and “Market Outlook.”

- Source: U.S. Trade Representative Announcements.

- TCJA Extensions:

- IRS Code Section: Multiple, including 26 U.S. Code § 1 (tax rates), § 199A (QBI deduction)

- Key Update: Set to expire December 31, 2025; Trump proposes permanence, including lifting the $10,000 SALT cap. Noted in “CPA Insights” and “Market Outlook.”

- Source: Congressional Budget Office (CBO) TCJA Analysis.

- Opportunity Zones (OZ):

- IRS Code Section: 26 U.S. Code § 1400Z-1 & 1400Z-2 – Opportunity Zones and Qualified Opportunity Funds

- Key Rule: Defers capital gains tax and offers tax-free growth after 10 years. Featured in “Evergreen Tax Strategies.”

- Source: IRS Opportunity Zone FAQs.

- Installment Sales:

- IRS Code Section: 26 U.S. Code § 453 – Installment Method

- Key Rule: Spreads capital gains tax over payment periods, ideal for property sales. See “Evergreen Tax Strategies.”

- Source: IRS Publication 537.

Real Estate Market Guidance

The following market data and trends provide context for our strategic insights this month:

- Residential Market Shifts:

- Days on Market: 56 days nationally (Redfin, February 2025), a five-year high, signaling a buyer’s market pivot. See “Market Outlook.”

- Inventory: 3.6 months of supply (NAR, January 2025), up from 2019 lows, with ~800,000 homes in Southern states.

- Home-Price-to-Rent Ratio: 15× nationally, 20–25× in metros like San Francisco and Denver (CoreLogic, January 2025), hinting at overvaluation risks.

- Mortgage Rates:

- Source: Freddie Mac PMMS (February 2025)

- Data: 30-year fixed at 6.7%, 15-year at 6.0%, potentially rising with tariff-driven inflation (see “CPA Insights”).

- Rent Growth Trends:

- Source: CoreLogic Single-Family Rent Index (January 2025)

- Data: 1.5% year-over-year growth, with declines in Austin (-1.2%) and Orlando (-0.8%), impacting investor ROI. Referenced in “Market Outlook” and “Q&A.”

- Commercial Real Estate:

- Office Vacancies: 16% nationally, 20%+ in NYC/SF (CBRE, Q1 2025)—see “Market Outlook.”

- Multifamily Cap Rates: 5.2% (CoStar, January 2025), steady despite rent slowdown.

- Industrial Strength: 4% vacancy, $8/sq. ft. leases (JLL, February 2025), a developer bright spot.

- Wall Street Valuation Concerns:

- Source: Invitation Homes Stock Analysis (February 2025)

- Data: Trading at a 35% discount to NAV ($310,000 vs. $410,000 market value), reflecting overvaluation fears—see “Market Outlook.”

- Accounting Tools for Error Prevention:

- Recommended: QuickBooks Online (transaction logging), Expensify (receipt tracking)—see “Avoid These Common Accounting Errors.”

- Source: Vendor Websites; Aiola CPA Best Practices.

Thank you for trusting Aiola CPA as your tax partner in real estate success. If there’s anything we can do to support your financial or investment journey, please don’t hesitate to reach out!

To your continued success,

The Aiola CPA Team

Contact Information & Next Steps

Turning Knowledge into Action:

We hope this edition of The Tax-Savvy Real Estate Investor has armed you with valuable information and sparked ideas for enhancing your tax efficiency, refining your accounting practices, and exploring new market opportunities. However, information alone is not enough—real transformation requires taking the next step.

How Aiola CPA Can Help:

As a specialized CPA firm focused on real estate, our mission is to deliver proactive advisory services that turn complexity into clarity. Whether you’re a seasoned investor with a diverse portfolio or a newcomer aiming to build a stable foundation, we’re here to help you tailor strategies that align with your unique goals.

Services Offered:

- Comprehensive Tax Planning: From optimizing depreciation deductions to structuring acquisitions and refining entity setups, we identify tax-saving strategies tailored to your situation.

- Accounting Guidance: We can help you select and implement the right software tools, establish proper accounting protocols, and maintain accurate records that support solid financial decisions and smooth tax filings.

- STR and REPS Consulting: We assist in documenting hours, structuring workflows, and meeting IRS criteria for the STR loophole and Real Estate Professional Status—unlocking substantial tax benefits.

- Transaction Support: Contemplating a 1031 exchange, a large-scale renovation, or a multi-property acquisition? We provide scenario analysis, cost/benefit evaluations, and guidance on optimal timing so you can execute moves with confidence.

The Consultation Process:

- Initial Inquiry: Complete our intake form and receive an email from us with a packet of information on our services and pricing, and a link to schedule an intro meeting.

- Discovery Meeting: We’ll schedule a complimentary 30-minute video meeting to assess your situation, provide more info on our services and how we can help, and outline potential next steps.

- Proposal & Engagement: After understanding your goals and reviewing initial information, we’ll propose a tailored service plan detailing the scope of work, deliverables, and fees.

- Ongoing Advisory & Implementation: Once engaged, we become your partner in navigating the financial and regulatory landscape. Through initial strategic discussions, regular check-ups, timely alerts on legislative changes, and real-time advice, we help you stay up-to-date and proactive rather than reactive.

Staying Informed & Connected:

- Playbook Subscription: If you received this playbook from a friend or colleague, be sure to subscribe directly on our website to ensure you never miss an update. We’ll continue to provide market insights, regulatory alerts, and strategic recommendations in future editions.

- Social Media & Blog Posts: We are committed to additional content rollouts this year, as well. Follow us on our various social media channels and visit our website’s blog for timely articles, quick tips, and breaking news that can affect your portfolio.

- Webinars & Workshops: Stay tuned for invitations to our upcoming educational webinars and workshops, where we discuss advanced topics like complex deal structuring, Opportunity Zone updates, or leveraging retirement accounts for real estate investing.

Our Commitment to Your Success:

At Aiola CPA, we measure our success by your results. By combining technical expertise, industry specialization, personal investment experience, and a client-centered approach, we aim to help you reduce tax liabilities, streamline operations, and ultimately build long-term wealth through real estate.

Ready to Take the Next Step?

Contact us today to schedule a discovery call and learn how we can help you make the most of your investments, navigate a changing tax landscape, and achieve your financial goals.