How Material Participation Impacts Real Estate Taxes

Material participation is one of the most important tax concepts for real estate investors to understand. This is what determines whether your activity is passive or nonpassive, and if you can use certain losses to offset other income. For many investors, qualifying as a material participant can open the door to significant tax benefits.

This guide will explain what material participation is, how you can qualify, and why it matters for your real estate tax strategy.

What Is Material Participation?

In simple terms, material participation means you are involved in an activity on a regular, continuous, and substantial basis. The rules come from IRC Section 469, which separates a business or investment into passive or nonpassive categories.

By default, most rental real estate is considered passive. However, if you meet the criteria for material participation, you may be able to move an activity into the nonpassive category. That matters because you can use nonpassive losses to offset other types of income, giving you more flexibility in your tax planning.

Material Participation Tests

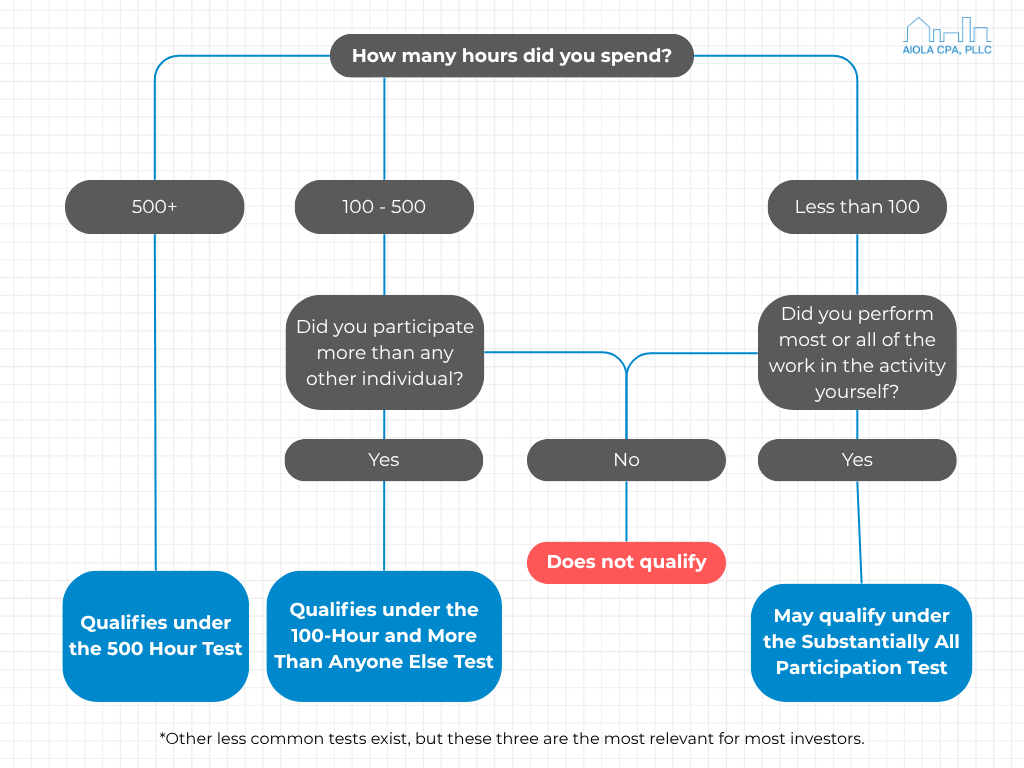

The IRS has seven tests for material participation. You only need to meet one to qualify, but these are the most relevant tests for real estate investors:

| 500-Hour Test | You participate in the activity for more than 500 hours during the year. |

| 100-Hour and More Than Anyone Else Test | You participate for at least 100 hours and more than any other individual. |

| Substantially All Participation Test | You perform most or all of the work in the activity yourself. |

Other tests exist, but these three are the most common in real estate and most defendable in an audit. Regardless of which test you meet, documentation is essential. Keep logs, calendars, and records to prove your participation if the IRS ever asks.

To help visualize these rules in action, this chart outlines how your time and activity can qualify under different participation tests.

Why It Matters for Real Estate Investors

Material participation determines if you can treat your rental activity as nonpassive. This is critical for:

- Real Estate Professional Status (REPS) eligibility

- Short-term rental tax strategies

- Cost segregation

- Maximizing tax losses against other types of income

There is also a notable “passive with active participation” exception for long-term rentals if your adjusted gross income is under $100,000, phasing out at $150,000. Active participation is less intensive than material participation but applies only to passive rental activities for those making less than $150,000.

Common Mistakes Investors Make

Many investors lose out on tax benefits because of avoidable mistakes, such as:

- Failing to keep a detailed time log throughout the year

- Not reconciling books monthly or keeping accurate records

- Assuming their CPA’s classification is enough without proof

- Confusing REPS and material participation as the same thing

How to Position Yourself for Material Participation

To strengthen your case:

- Track your time consistently and proactively

- Understand which material participation test you are aiming to meet

- Consult a tax professional before reporting your activity as nonpassive

Final Thoughts

Material participation is not just a box to check. It can be the key to unlocking valuable tax benefits for real estate investors. By understanding the rules, keeping strong records, and working with an experienced CPA, you can make the most of this classification and begin advanced tax planning.

Ready to evaluate your situation? Schedule a consultation with Aiola CPA, and let’s create a tax strategy that works for you.