You’ve saved up some money and are ready to open an IRA. The good news is, that’s the hardest part. The bad news is, you’re not sure whether a Roth IRA or Traditional IRA is the right one for you.

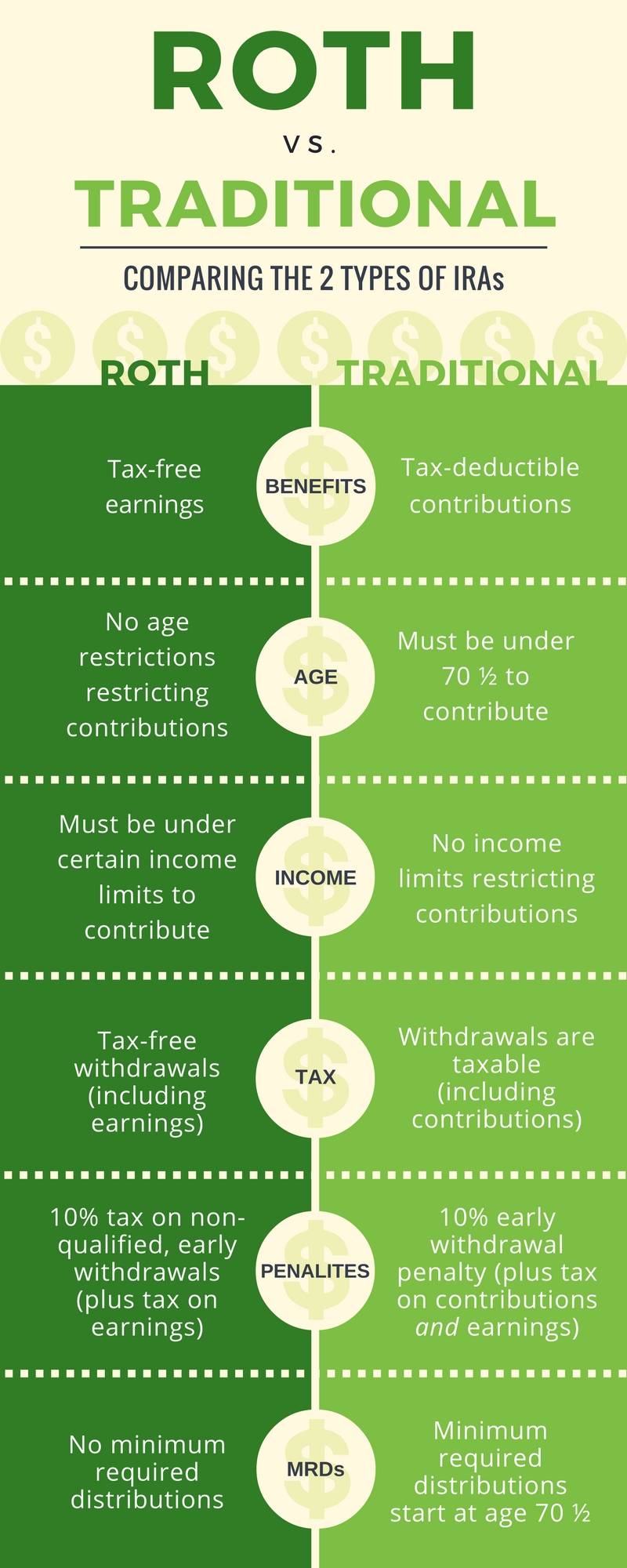

Check out the comparison below:

Similarities

Despite some pretty significant differences between the two, Roth and Traditional IRAs have the following in common:

- Maximum annual contribution – $5,500 for 2016

- Catch-up contribution – additional annual contribution of $1,000 for individuals age 50 or older (bringing the max annual contribution to $6,500 for 2016)

- Final annual contribution date – April 15 of the year following the contribution year (for example, contributions for 2016 can be made until April 17, 2017*)

- Early withdrawal penalty exceptions – up to $10,000 can be withdrawn, penalty-free, for first-time home-buying expenses (Roth IRA requires a five-year aging requirement to be penalty-free; traditional IRA offers other exceptions as well)

- They’re both a great investment

*April 15 falls on a weekend in 2017, so the final contribution date is pushed back to the next business day.

My Two Cents…

This photo, “my2cents”, is copyright (c) 2006 yatoobin and made available under an Attribution-Noncommercial-Share Alike 2.0 license

…in using the broadest scenarios possible: If you’re young, don’t absolutely need a tax deduction at the moment, and your income is below the limits, then go with the Roth IRA; you will have years of tax-free growth. If you’re close to retirement and will immediately benefit from a tax deduction that lowers your AGI, invest in a traditional IRA.

With that said, every scenario is different and the best choice for you depends on your unique situation. If you are unsure about which route is best for you, reach out to us for quality advice that’s specific to you, and some mediocre jokes along the way.

Aiola CPA, PLLC is a 100% virtual CPA firm, specializing in tax planning and preparation for real estate investors. See more at www.aiolacpa.com

Pingback: When You Should Expect to Receive Your Tax Forms | Aiola CPA, PLLC